Cheaper Or Costlier? How GST May Impact Prices Of Goods

GST or goods and services tax changed the indirect tax landscape of the country from July 1 by subsuming over a dozen of state and central taxes. Since GST is meant to eliminate “tax on tax”, experts say overall tax burden on goods is expected to fall over time. Many essential goods such as unpacked food grains, gur, milk, eggs and salt won’t attract any tax under GST. Some services will get costlier as banking and financial services have been put in the 18 per cent rate slab under GST, from 15 per cent earlier.

“However, going forward, it is expected that due to reduced cost because of availability of GST credit on items hitherto not available, the price of services will also come down which will benefit the consumers,” says Sandeep Sehgal, director-tax and regulatory at Ashok Maheshwary & Associates LLP.

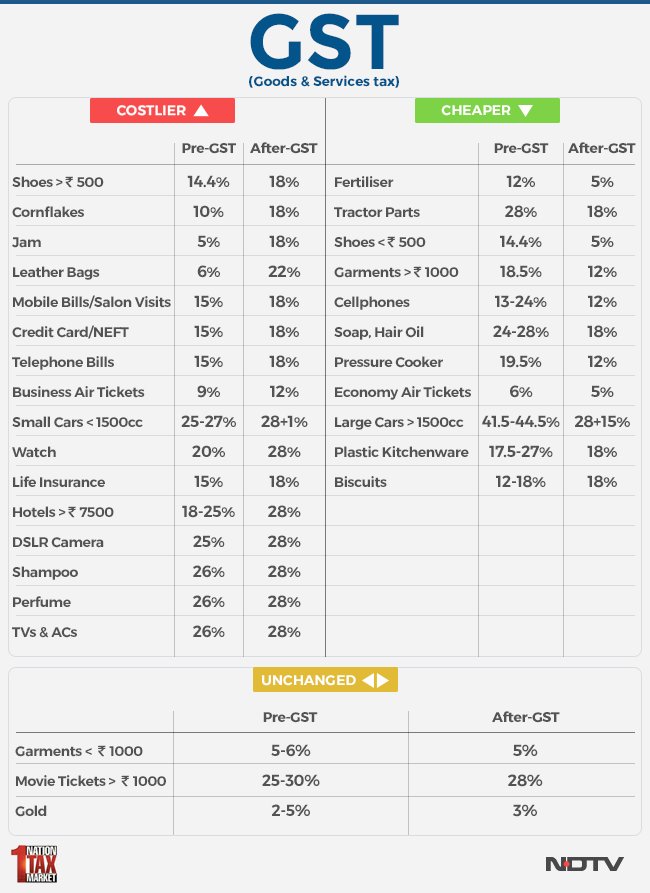

After GST rollout, many items like footwear below Rs. 500 and garments could become cheaper. On the other hand, items like TV and small cars could become costlier.

Petroleum products such as petrol, diesel and aviation turbine fuel have been kept out of GST as of now. The GST Council will take a decision on it at a later date. Alcohol has also been kept out of GST.

Here is the list of goods, their current effective tax rates and respective GST rates under the new tax system, according to professional services firm EY:

Similar Posts:

- what are the most impacted items due to GST on each items categories

- CSD: Clarification on issued SOPs to all companies supplying Goods, Cars, Two Wheelers

- Applicability of Goods and Service tax (GST) on Static Catering Services on IR

- FAQ on Implementation of GST at Depots

- AICPIN for the month July 2015 – Expected Today